If you've been hanging around property developers for any period of time, or in fact property investors in general, then you'll definitely have heard the word "equity".

So you might be surprised to see that I'm devoting a "Learning the Lingo" blog to the topic!

Well, that's because equity is a tricky little beast, changing its meaning depending on its surroundings. Kind of like a property developing chameleon!

Don't believe me?

Let's start with the most common way in which the word "equity" is used.

Residential Equity

If I asked a bunch of people to give me a definition for the word equity, then this is usually what they'll say: "the difference between the value of the property and the loan against it".

And this is exactly what equity means in a residential context. It's kind of the inverse of the Loan to Value Ratio (LVR) that's often talked about.

For example, if you have an LVR of 80% on a property, then you have equity of 20%.

Where it gets interesting, though, is that if you were talking to a broker or lender, you would say "I have a 20% deposit for the property".

So on a residential loan, you have a deposit, a loan and if your property rises in value, you also have equity. Just to confuse things, though, once the loan is underway, most people do tend to lump the deposit and equity together into one, and call it equity. Which means you end up with equity and a loan.

Which leads us into...

Commercial Equity

If you were talking to a commercial broker or lender, though, you would say "I have equity of 20%".

Commercial loans tend to be spoken of in terms of equity and debt. Over time the levels of both change as the property's value or the amount of debt paid down changes, but it's still called equity and debt. No confusing changes in context there!

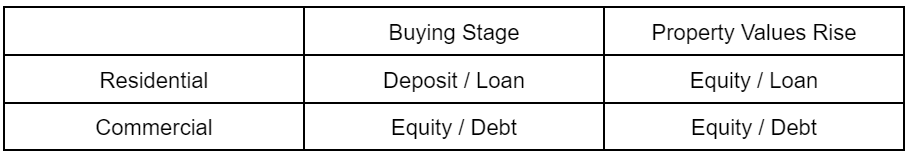

Here's a table to show what I mean:

And just when you thought you'd finally got a handle on this slippery little word "equity", let's add a 3rd variety into the mix.

Available Working Equity

Now, I have to say this isn't a phrase I use a lot, but it's the same as when I talk about Liquid Cash.

Essentially, this is money you have available that you can access in order to run a deal already once it’s underway.

Let's look at an example. Say you have a line of credit with $80k sitting in it. When you engage a town planner and need to pay for their services, you can draw money out of the line of credit for that purpose.

Let's look at an example. Say you have a line of credit with $80k sitting in it. When you engage a town planner and need to pay for their services, you can draw money out of the line of credit for that purpose.

That's only one example, but there are many more. These are the types of costs you need to pay to make a deal happen, but you can't usually borrow more initially for them. They have to be funded from a different source - in other words, liquid cash.

Just to break that down a little more...

In order to develop a property, you need 3 types of money. You need:

Let me explain. Your house has risen in value, and the LVR of your loan is now 70% - you've gained some equity. But if you're in a situation where the bank won't allow you to borrow more against that property, then it's only equity, not liquid cash. Equity locked in a property doesn't qualify, because you can't use it.

Borrowed Equity

Borrowing equity is generally what you do when you bring a private lender into your property development deal and pay them interest on their funds. Sometimes you might use that equity to fund the shortfall between the property price and the amount you can borrow, or you might use it as liquid cash to run the deal.

So there you have it. Equity is a wonderful thing, and a very necessary part of property developing. Hopefully now you have a better understanding of how this chameleon of a word changes to match the context it's used in.

So you might be surprised to see that I'm devoting a "Learning the Lingo" blog to the topic!

Well, that's because equity is a tricky little beast, changing its meaning depending on its surroundings. Kind of like a property developing chameleon!

Don't believe me?

Let's start with the most common way in which the word "equity" is used.

Residential Equity

If I asked a bunch of people to give me a definition for the word equity, then this is usually what they'll say: "the difference between the value of the property and the loan against it".

And this is exactly what equity means in a residential context. It's kind of the inverse of the Loan to Value Ratio (LVR) that's often talked about.

For example, if you have an LVR of 80% on a property, then you have equity of 20%.

Where it gets interesting, though, is that if you were talking to a broker or lender, you would say "I have a 20% deposit for the property".

So on a residential loan, you have a deposit, a loan and if your property rises in value, you also have equity. Just to confuse things, though, once the loan is underway, most people do tend to lump the deposit and equity together into one, and call it equity. Which means you end up with equity and a loan.

Which leads us into...

Commercial Equity

If you were talking to a commercial broker or lender, though, you would say "I have equity of 20%".

Commercial loans tend to be spoken of in terms of equity and debt. Over time the levels of both change as the property's value or the amount of debt paid down changes, but it's still called equity and debt. No confusing changes in context there!

Here's a table to show what I mean:

And just when you thought you'd finally got a handle on this slippery little word "equity", let's add a 3rd variety into the mix.

Available Working Equity

Now, I have to say this isn't a phrase I use a lot, but it's the same as when I talk about Liquid Cash.

Essentially, this is money you have available that you can access in order to run a deal already once it’s underway.

That's only one example, but there are many more. These are the types of costs you need to pay to make a deal happen, but you can't usually borrow more initially for them. They have to be funded from a different source - in other words, liquid cash.

Just to break that down a little more...

In order to develop a property, you need 3 types of money. You need:

- a deposit/equity in order to get finance to buy the property

- a loan/debt for the balance of funds to buy the property

- liquid cash to run the development deal.

Let me explain. Your house has risen in value, and the LVR of your loan is now 70% - you've gained some equity. But if you're in a situation where the bank won't allow you to borrow more against that property, then it's only equity, not liquid cash. Equity locked in a property doesn't qualify, because you can't use it.

Borrowed Equity

Borrowing equity is generally what you do when you bring a private lender into your property development deal and pay them interest on their funds. Sometimes you might use that equity to fund the shortfall between the property price and the amount you can borrow, or you might use it as liquid cash to run the deal.

So there you have it. Equity is a wonderful thing, and a very necessary part of property developing. Hopefully now you have a better understanding of how this chameleon of a word changes to match the context it's used in.