Imagine if you had a crystal ball that showed exactly what’s up next for the residential property market…

You could plan a property development and execute in the smug knowledge that you’re right on track for a big payday.

Well, I don’t have a crystal ball, but I can teach you about market drivers.

If you can get your head around drivers, you’ll be way ahead of the pack when it comes to predicting what will happen next in your local market.

When the media and property commentators talk about the market they tend to be talking about a thing called a property indicator. An indicator is something that has already happened, it's in the past.

Auction clearance rates and median house prices are great examples. They provide a snapshot of what’s been happening in the market over a certain period of time. But they’re lagging indicators, capturing activity that is already months’ old.

Think about it. A vendor starts by thinking “Do I actually want to put this on the market?” If they decide to go ahead they then have to go and research the local agents, prepare the property for sale, put the marketing package together, do open homes, find a buyer, sign a contract, and finally go and settle.

So when you see a settlement finalised, it's typically a reflection of what was happening four months ago. And because of that, an indicator can be quite misleading because it’s a reflection of what's already happened, rather than what’s about to happen.

What we want to do is we want to start thinking about what's going to happen next.

And that means understanding what’s actually driving the market.

So, what are drivers?

Property drivers are the underlying market forces that cause the market to move.

Note that what we’re looking for is what’s about to happen with property at a local level.

We need to keep in mind the big picture: state, regional cities, capital cities, suburbs and all the different dwelling types and realise that there's markets within markets within markets.

So we don't want to be generic, with the kind of broad view you’ll hear in the media.

Rather, we want to narrow it all the way down to what is actually happening in my city, in my suburb, with the exact strategy that I want to do.

That way we can discover if there's an oversupply of one kind of stock and an undersupply of another kind of stock. That will tell us if one is going to shoot up and the other one's heading south.

Maybe the suburb right next door tells a completely different story.

This is where you’ll start forming some really clear views on exactly what you’re going to do.

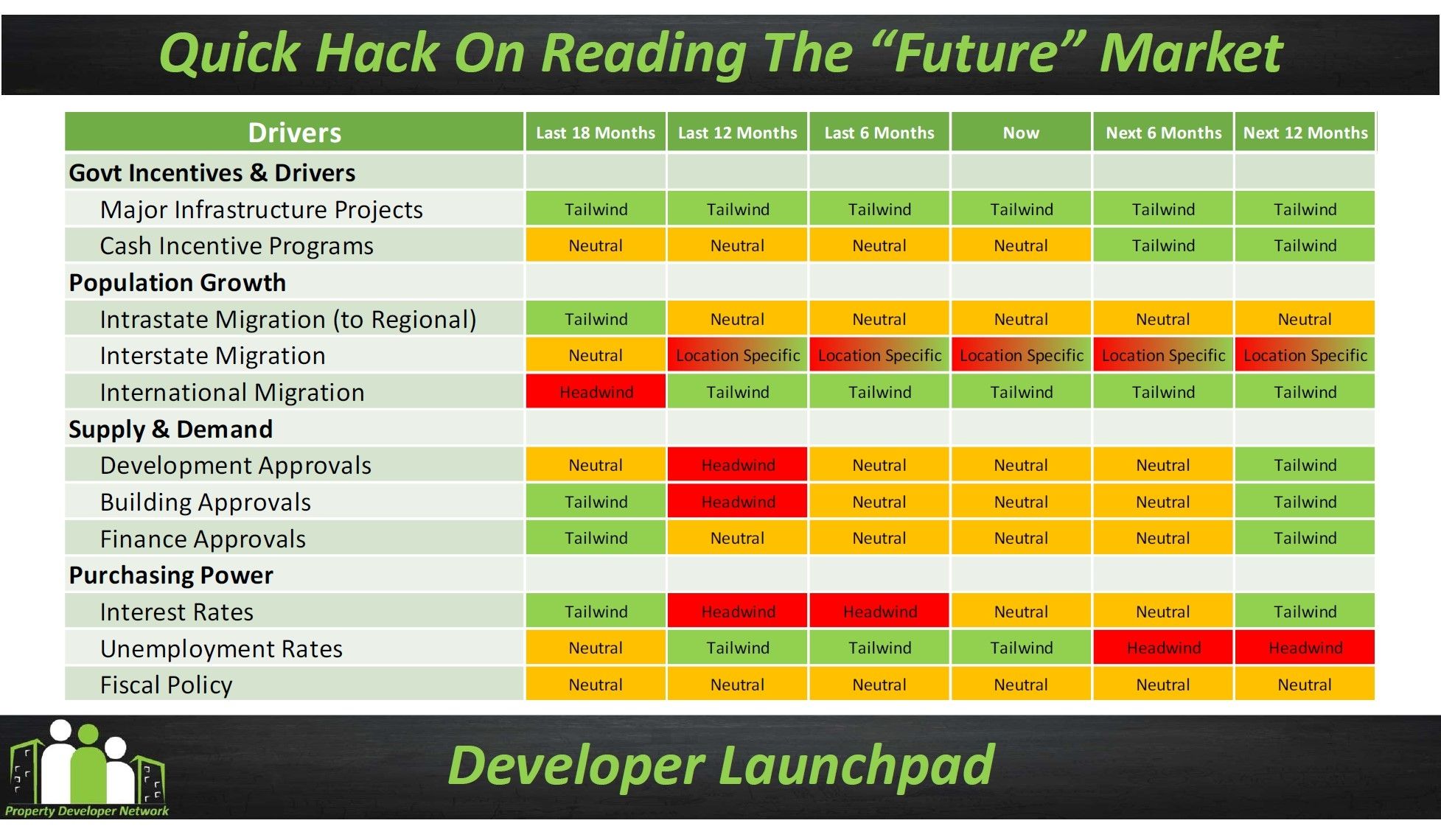

When it comes to market drivers, there are four key categories.

1. Government incentives

This covers major infrastructure projects at the Federal, State and Local Government level. We’re talking about transport infrastructure like new roads or a new metro line, health and medical facilities, new schools, new stadiums or sports facilities for a major event.

This category also includes any cash incentives and bonuses that are being offered, like a first home owner grant or a new build bonus.

2. Population growth

In this category you’ve got births, deaths and marriages, intrastate migration, interstate migration and international migration.

3. Supply and demand

This covers development approvals, building approvals and finance approvals.

By looking at development approvals you can get a handle on the pipeline of supply. Building approvals tell us whether that potential is starting to be realized, which means homes are about to be constructed. Finance approvals show funding has been acquired to buy a property or kick off a build.

4. Purchasing power

Here we’re talking about unemployment rates, interest rates and fiscal policy. These give us an idea of household income and consumption.

Your homework

All of these market forces are measured and publicly reported, so your job is to do a whole bunch of research.

You need to find out how much is actually being spent on government infrastructure.

You need to find out how much is actually being spent on government infrastructure.

How much is being spent on cash incentives to move the market forward?

What's happening with regards to our population growth rates?

Is unemployment rising or falling?

Is there a huge pipeline of dwellings that could spell an oversupply in a particular suburb?

It’s a little bit of a black art, but the more homework you do, the more you’ll start to see a picture of the future forming.

You’ll discover headwinds and tailwinds.

Headwinds are forces that are making it harder for the market to move, for example interest rates rising or a population falling as people move elsewhere.

Tailwinds are helping to push the market forward, things like a major road upgrade or an increase in finance approvals or record low unemployment rates.

Once tailwinds outnumber headwinds, there’s a good chance the market is dishing up opportunity, and savvy developers can jump on board.

You could plan a property development and execute in the smug knowledge that you’re right on track for a big payday.

Well, I don’t have a crystal ball, but I can teach you about market drivers.

If you can get your head around drivers, you’ll be way ahead of the pack when it comes to predicting what will happen next in your local market.

When the media and property commentators talk about the market they tend to be talking about a thing called a property indicator. An indicator is something that has already happened, it's in the past.

Auction clearance rates and median house prices are great examples. They provide a snapshot of what’s been happening in the market over a certain period of time. But they’re lagging indicators, capturing activity that is already months’ old.

Think about it. A vendor starts by thinking “Do I actually want to put this on the market?” If they decide to go ahead they then have to go and research the local agents, prepare the property for sale, put the marketing package together, do open homes, find a buyer, sign a contract, and finally go and settle.

So when you see a settlement finalised, it's typically a reflection of what was happening four months ago. And because of that, an indicator can be quite misleading because it’s a reflection of what's already happened, rather than what’s about to happen.

What we want to do is we want to start thinking about what's going to happen next.

And that means understanding what’s actually driving the market.

So, what are drivers?

Property drivers are the underlying market forces that cause the market to move.

Note that what we’re looking for is what’s about to happen with property at a local level.

We need to keep in mind the big picture: state, regional cities, capital cities, suburbs and all the different dwelling types and realise that there's markets within markets within markets.

So we don't want to be generic, with the kind of broad view you’ll hear in the media.

Rather, we want to narrow it all the way down to what is actually happening in my city, in my suburb, with the exact strategy that I want to do.

That way we can discover if there's an oversupply of one kind of stock and an undersupply of another kind of stock. That will tell us if one is going to shoot up and the other one's heading south.

Maybe the suburb right next door tells a completely different story.

This is where you’ll start forming some really clear views on exactly what you’re going to do.

When it comes to market drivers, there are four key categories.

1. Government incentives

This covers major infrastructure projects at the Federal, State and Local Government level. We’re talking about transport infrastructure like new roads or a new metro line, health and medical facilities, new schools, new stadiums or sports facilities for a major event.

This category also includes any cash incentives and bonuses that are being offered, like a first home owner grant or a new build bonus.

2. Population growth

In this category you’ve got births, deaths and marriages, intrastate migration, interstate migration and international migration.

3. Supply and demand

This covers development approvals, building approvals and finance approvals.

By looking at development approvals you can get a handle on the pipeline of supply. Building approvals tell us whether that potential is starting to be realized, which means homes are about to be constructed. Finance approvals show funding has been acquired to buy a property or kick off a build.

4. Purchasing power

Here we’re talking about unemployment rates, interest rates and fiscal policy. These give us an idea of household income and consumption.

Your homework

All of these market forces are measured and publicly reported, so your job is to do a whole bunch of research.

How much is being spent on cash incentives to move the market forward?

What's happening with regards to our population growth rates?

Is unemployment rising or falling?

Is there a huge pipeline of dwellings that could spell an oversupply in a particular suburb?

It’s a little bit of a black art, but the more homework you do, the more you’ll start to see a picture of the future forming.

You’ll discover headwinds and tailwinds.

Headwinds are forces that are making it harder for the market to move, for example interest rates rising or a population falling as people move elsewhere.

Tailwinds are helping to push the market forward, things like a major road upgrade or an increase in finance approvals or record low unemployment rates.

Once tailwinds outnumber headwinds, there’s a good chance the market is dishing up opportunity, and savvy developers can jump on board.