Interest rates are an important financial element of being a successful Property Developer or Investor. Choosing whether to use a residential home loan or commercial finance is one part of the equation, but it's not the only one.

Another aspect to consider is whether to use an interest-only or principal and interest loan. I often get asked which is better, and the answer (one I use a lot and I know you hate!) is: “it depends”.

Let's take a deep dive into the pros and cons of each option, so you can determine which is the better option for you in your situation.

Interest Only Loans

Interest Only Loans

I'm going to start with this one, because it's more likely to be the preferred choice for Property Developers. Why? Because if you're using commercial finance, it's often your only choice!

But there are more factors to consider, particularly if you can use interest-only with a residential loan.

Lower Initial Payments: Interest-only loans offer lower initial monthly payments since you're only required to pay the interest, not the principal. This is one of the big attractions, particularly if you're borrowing large amounts of money to fund a construction project.

Cash Flow Flexibility: Switching to this type of loan can be helpful if you anticipate a temporary reduction in income in the near future. For developers, it provides flexibility in managing your cash flow.

Opportunity: Interest-only loans can free up cash flow to fund other investments while maintaining the ability to write off interest payments for tax purposes.

Short-Term Ownership: Interest-only loans can be suitable if you're only going to own the property for a short period while developing it. It gives you the ability to minimise your mortgage payments during that time.

This is particularly beneficial for developers who expect a property's value to appreciate significantly in the short term due to development. They can sell or refinance the property before the interest-only period ends, thereby reducing their total interest cost.

Of course, like most things in life, not everything is rosy in the interest-only world! Let's take a look at the down side.

Risk: Interest-only loans carry higher risk since you're not actively paying down the principal. This means you won't build equity unless the property appreciates in value.

Higher Total Interest Cost: If you have the loan for a long period, you may end up paying more in interest compared to a principal and interest loan because the principal never reduces.

Refinancing: After the interest-only period ends, you may need to refinance or start paying the principal, most likely resulting in higher monthly payments. This can cause problems with your cash flow.

Principal and Interest Loans

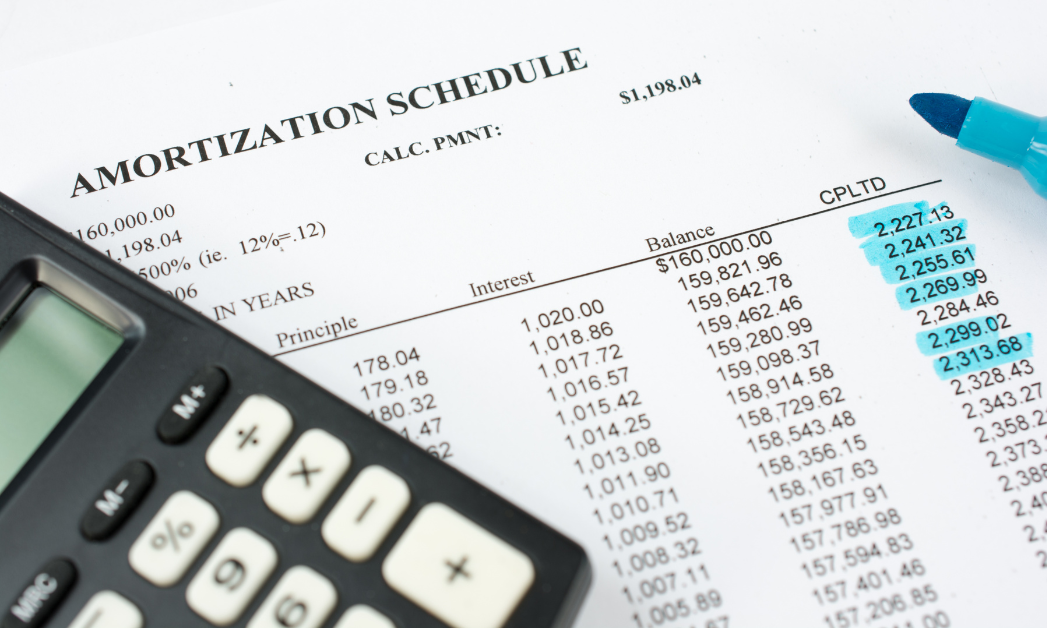

If you've got a home loan, chances are this is the type of loan you have. Each payment pays a little piece of the amount borrowed back to the lender, and the rest pays interest costs. Let's look at the benefits of this option.

Building Equity: Your monthly payments go towards both the interest and reducing the loan's principal amount. Over time, as you pay off the principal, you build equity in your property. For the first few years of the loan chances are you'll make very little progress in paying down the loan amount, but as time passes, that starts to accelerate.

Building Equity: Your monthly payments go towards both the interest and reducing the loan's principal amount. Over time, as you pay off the principal, you build equity in your property. For the first few years of the loan chances are you'll make very little progress in paying down the loan amount, but as time passes, that starts to accelerate.

Lower Total Interest Cost: Since you're steadily paying down the principal, the total interest cost over the life of the loan is typically lower compared to interest-only loans.

The biggest downside to a principal and interest loan is that it costs more.

Higher Initial Payments: The initial payments for P&I loans are typically higher than those for interest-only loans since they include both principal and interest.

Cash Flow Constraints: Higher initial payments could affect short-term cash flow, especially if it’s going to take some time before the property generates revenue through rents or sale.

In summary, principal and interest loans are generally more suitable for long-term ownership and building equity, so tend to suit property investors who want to keep stock as rentals.

An interest-only loan, given the repayments are lower, is generally the preferred choice of property developers. It helps keep cash outlay to a minimum, freeing up funds for other development costs.

Before choosing a loan type, it's essential to consider your financial goals, risk tolerance, and the specific terms and conditions of each loan option. Seek advice from professionals in order to make the best decision for your circumstances.

Another aspect to consider is whether to use an interest-only or principal and interest loan. I often get asked which is better, and the answer (one I use a lot and I know you hate!) is: “it depends”.

Let's take a deep dive into the pros and cons of each option, so you can determine which is the better option for you in your situation.

I'm going to start with this one, because it's more likely to be the preferred choice for Property Developers. Why? Because if you're using commercial finance, it's often your only choice!

But there are more factors to consider, particularly if you can use interest-only with a residential loan.

Lower Initial Payments: Interest-only loans offer lower initial monthly payments since you're only required to pay the interest, not the principal. This is one of the big attractions, particularly if you're borrowing large amounts of money to fund a construction project.

Cash Flow Flexibility: Switching to this type of loan can be helpful if you anticipate a temporary reduction in income in the near future. For developers, it provides flexibility in managing your cash flow.

Opportunity: Interest-only loans can free up cash flow to fund other investments while maintaining the ability to write off interest payments for tax purposes.

Short-Term Ownership: Interest-only loans can be suitable if you're only going to own the property for a short period while developing it. It gives you the ability to minimise your mortgage payments during that time.

This is particularly beneficial for developers who expect a property's value to appreciate significantly in the short term due to development. They can sell or refinance the property before the interest-only period ends, thereby reducing their total interest cost.

Of course, like most things in life, not everything is rosy in the interest-only world! Let's take a look at the down side.

Risk: Interest-only loans carry higher risk since you're not actively paying down the principal. This means you won't build equity unless the property appreciates in value.

Higher Total Interest Cost: If you have the loan for a long period, you may end up paying more in interest compared to a principal and interest loan because the principal never reduces.

Refinancing: After the interest-only period ends, you may need to refinance or start paying the principal, most likely resulting in higher monthly payments. This can cause problems with your cash flow.

Principal and Interest Loans

If you've got a home loan, chances are this is the type of loan you have. Each payment pays a little piece of the amount borrowed back to the lender, and the rest pays interest costs. Let's look at the benefits of this option.

Lower Total Interest Cost: Since you're steadily paying down the principal, the total interest cost over the life of the loan is typically lower compared to interest-only loans.

The biggest downside to a principal and interest loan is that it costs more.

Higher Initial Payments: The initial payments for P&I loans are typically higher than those for interest-only loans since they include both principal and interest.

Cash Flow Constraints: Higher initial payments could affect short-term cash flow, especially if it’s going to take some time before the property generates revenue through rents or sale.

In summary, principal and interest loans are generally more suitable for long-term ownership and building equity, so tend to suit property investors who want to keep stock as rentals.

An interest-only loan, given the repayments are lower, is generally the preferred choice of property developers. It helps keep cash outlay to a minimum, freeing up funds for other development costs.

Before choosing a loan type, it's essential to consider your financial goals, risk tolerance, and the specific terms and conditions of each loan option. Seek advice from professionals in order to make the best decision for your circumstances.